There are two reasons for the new focus on the Social Security retirement program.

The first is that the Republican Party regained control of the House and, with a Democratic Senate and a Democratic president, the party has jostled its hibernating concerns about government spending back into consciousness.

The second is that the country is getting a lot older, very quickly, raising concerns about whether the program will be able to provide the support that retiring Americans had expected.

This rapid aging is not a surprise. Demographers — much less any American with a rudimentary familiarity with the 20th century — have understood since the 1950s that this moment was coming. It’s a function of the baby boom, a surge in the country’s population that, through sheer scale, consistently broke existing systems as it aged: schools, the job market, you name it. In 2011, the boomers started hitting 65; children born in 1957, the peak year for births during the boom, began hitting retirement age last year.

Well, sort of. In 1983, Congress shifted the age at which Americans were eligible for full retirement benefits upward slightly. Over the course of more than two decades, the age was adjusted upward incrementally from 65 to 67. It’s based on year of birth, so while those 1957 kids were hitting 65 in 2022, the age at which they could receive full benefits had slipped just out of reach to age 66½.

This delay was in part meant to address concerns about whether the system would eventually be able to handle the increase in retirees. As baby boomers were active in the workforce (which, of course, many still are), they paid into the system. Now that they are retiring, they are drawing down from it. Rapidly. The current funding trajectory suggests that future benefits will need to be scaled back to maintain solvency.

On Tuesday, Semafor reported that a group of senators was mulling a possible response to that problem: further increasing the age at which a retiree is eligible for full benefits to 70.

Such a change would be dramatic, certainly, and would over the short term disadvantage a lot of older Americans who 1) tend to vote more heavily and 2) tend to vote more heavily Republican, suggesting that the proposal faces an uphill climb. (President Biden has been enthusiastic about using Social Security as a political wedge against Republicans.) But a look at the projected future population of the country also shows that increasing the age would have a fairly subtle effect.

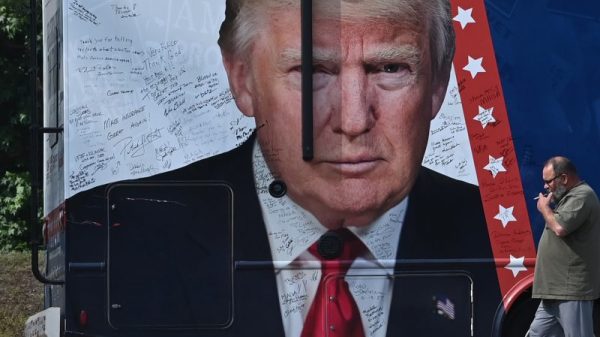

The Census Bureau projects the population of the country by year into the near future. In 2017, it released projections looking forward to 2060. They’re out of date, obviously, in part because of the pandemic and in part because of Donald Trump’s efforts to limit immigration. But they nonetheless offer a useful illustration of the challenge.

Below are three graphs for each of four years: 2020, 2030, 2040 and 2060. The first graph shows the distribution of full benefits had the retirement age been kept at 65. The second shows the 1983 adjustment over time, ending at 67. The third shows the effects of raising the age to 70.

The main thing to notice here is the size of the orange section in 2060 (lower right) relative to 2020 (upper left). Yes, raising the retirement age to 70 reduces the number of people eligible for full benefits, but the expansion of the older population above that age means that the full-benefit-eligible population is still soaring.

A table shows the change. For each year below, we see the change in the number of full-benefit recipients by first implementing the 1983 change and, second, by raising the age to 70. (That’s identified as “proposed.”) To see the full effect of the 1983 change and the proposed change, simply add the percentages together. In other words, the 1983 change and the proposed change would have dropped the number of full-benefit eligible Americans by 32 percent in 2020 relative to keeping it at 65. (Again, this is because the boomers have just been hitting retirement age.)

The most important line is at the bottom. It shows the increase in recipients relative to the 2020 level even if the age is increased to 70. In 2030, there will be 39 percent more people ages 70 or older than there were in 2020. By 2060, the increase will be 88 percent.

In other words, increasing the age has a short-term effect but isn’t, by itself, a long-term solution. Other proposals are in the mix, of course, including increased taxes on higher-salary Americans.

The challenge, fundamentally, is that there are a lot of Americans who are living longer. Something we could have seen coming for about the past 76 years.